New York Non-Profit Corporations

Get expert legal help to set up and manage your Non-Profit Corporation in NY seamlessly. A New York Not-for-Profit Corporation is a corporation formed in accordance with the New York Not-for-Profit Corporation Law. A NY Not-for-Profit Corporation may be formed as either a Charitable Corporation or a Non-Charitable Corporation (as defined in Not-for-Profit Corporation Law section 102).

A New York Not-for-Profit Corporation may not be formed for profit or financial gain. Furthermore, the New York Not-for-Profit Corporation’s assets, income, or profit may not be distributed to or used for the benefit of the corporation’s members, directors, or officers. However, the Not-for-Profit Corporation Law sections 102 (a)(5) and 515 do permit the corporation to pay reasonable salary or compensation for services provided to the corporation.

Forming a New York Non-Profit Corporation

If you are forming a non-profit corporation, we can assist you by providing the following services:

- Draft the Certificate of Incorporation for a Non-Profit Corporation

- Obtain Consent to Filing with the Department of State from the applicable agency, such as the New York State Department of Education (The particular agency whose consent may be required will depend on the nature and purpose of the non-profit corporation.)

- Obtain Federal Tax Identification Number

- File New York State Registration Statement For Charitable Organizations

- Obtain New York State Attorney General’s Consent to Tax Exempt Status

- File Application for Recognition of Exemption Under Internal Revenue Code Section 501(c)(3)

We Can Help Obtain Required Consent from New York State Agencies or Departments for Your New York Non-Profit Corporation

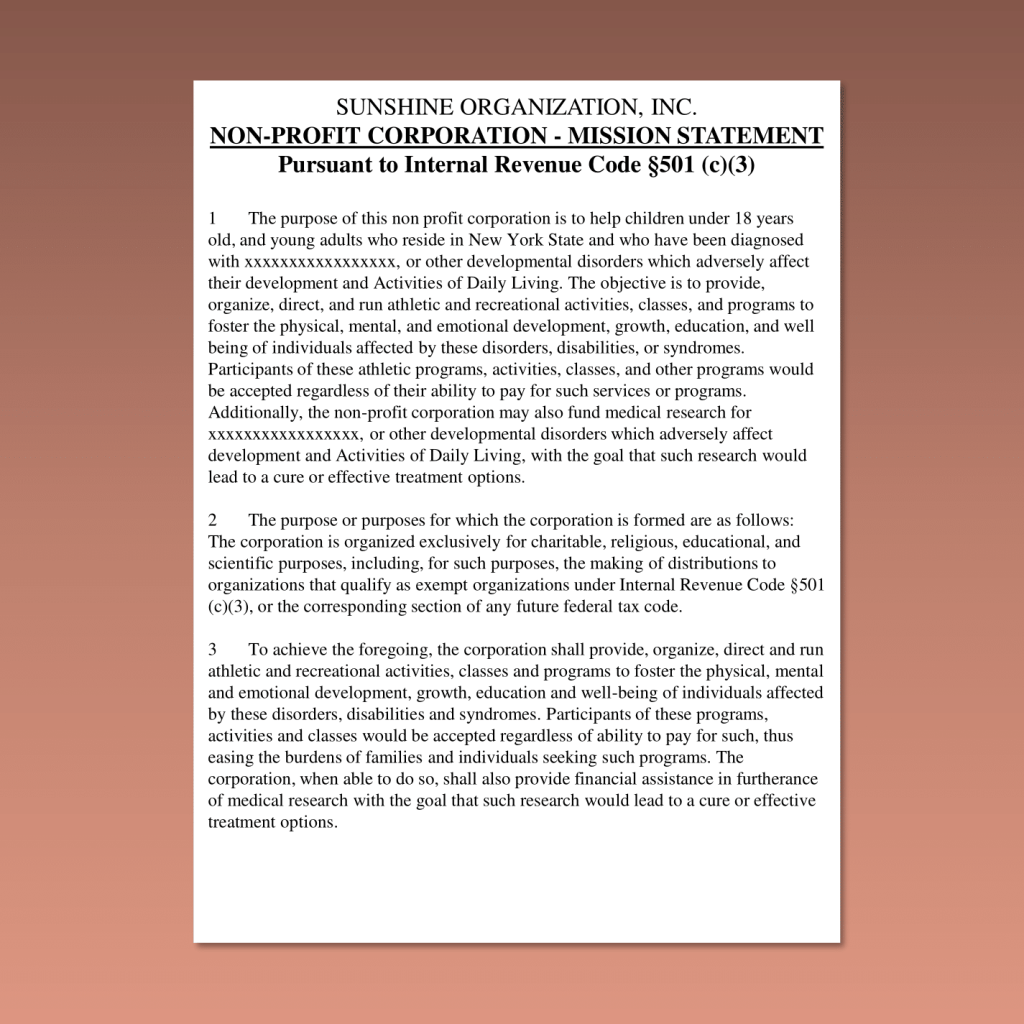

When drafting the Certificate of Incorporation for a Non-Profit Corporation, there are various requirements to ensure that it will be accepted by the New York State Department of State, and that it will be approved by the applicable New York State agencies or departments whose consent may be required.

Can a 16-Year-Old Serve as a Director of a New York Non-Profit Corporation?

Non-profit corporations are sometimes conceived by young adults under the age of 18. Although directors of a non-profit corporation are generally required to be at least 18 years of age, under certain circumstances, a person who is between the ages of 16 and 18 years of age may serve as a director of a non-profit corporation.

To permit the New York Non-Profit Corporation to have a director between 16 and 18 years of age, the Certificate of Incorporation must be carefully drafted to take advantage of the legal provision that may permit such age person to serve as a director.

The Certificate of Incorporation of a New York Non Profit Corporation Must Be Carefully Prepared to Satisfy Various Legal Requirements

The Certificate of Incorporation of a non-profit corporation must be meticulously drafted, in order to satisfy all legal requirements, and to facilitate obtaining any required approvals from New York State agencies or departments, as well as to secure tax-exempt status for the non-profit corporation.

Contact Our New York Non-Profit Corporation Lawyer

To form a New York Non-Profit Corporation, or discuss your legal matter with a New York Non-Profit Corporation business lawyer, we invite you to complete our Non-Profit Corporation Questionnaire, or click Contact Us. You may also call Michael W. Goldstein for a free initial telephone consultation, or to schedule a consultation at our office.

New York Non Profit Corporation Lawyer Disclaimer

The information contained in this website is not intended to constitute legal advice, nor to create an attorney-client relationship or lawyer-client relationship. We recommend that you discuss your legal matter or case with a NY lawyer or New York attorney promptly.

Visiting our website, submitting any information via questionnaire or email, or discussing your case with us does not create an attorney-client relationship. An attorney-client relationship with our law firm can only be established with the signing of a written retainer agreement prepared by our law firm.

Prior results do not guarantee or predict a similar outcome concerning any future case or legal matter.

This website is not intended to solicit clients for commercial law, commercial litigation, contracts, or any other legal matter outside of New York State.

However, we do represent clients who live outside of New York State and are engaged in a New York State commercial transaction, or New York commercial litigation, or who need legal services for other legal matters that involve New York law, or a dispute that is or may be litigated in the courts of New York State, or disputes that may be arbitrated or mediated in a New York State Alternative Dispute Resolution forum.

Our website contains general information regarding New York contracts and commercial law. The information in this website involving New York business law, contract law, commercial transactions, joint venture agreements, employment contracts, independent contractor agreements, construction contracts, home renovation contracts, and other commercial agreements, NY business law, NY contract law, NY commercial law, and New York commercial litigation, or other New York legal information contained in this website is not intended to constitute legal advice, nor to create an attorney-client relationship or lawyer-client relationship.

We recommend that you discuss your business law, commercial law, or other legal matters with a NY business lawyer or New York commercial attorney promptly.

Law Offices of Michael W. Goldstein is a New York commercial transactions and business law firm, New York commercial lawyer, and NY business attorney, also representing clients in commercial litigation. We represent clients in New York contracts, N.Y. business transactions, New York commercial litigation, and all other legal matters affecting businesses in New York State.

We also represent clients in various legal matters involving business and commercial law, as well as commercial litigation throughout New York State, including New York City, Manhattan, Bronx, Brooklyn, Queens, Staten Island, Long Island, Nassau County, Suffolk County, Westchester County, Rockland County, and upstate New York.

Law Offices of Michael W. Goldstein

New York Non-Profit Corporation Lawyer

Telephone: (212) 571-6848

Free Phone Consultation

Attorney Advertising