New York Real Estate Down Payment Disputes

Who Gets the Down Payment When a New York Real Estate Transaction Does Not Close?

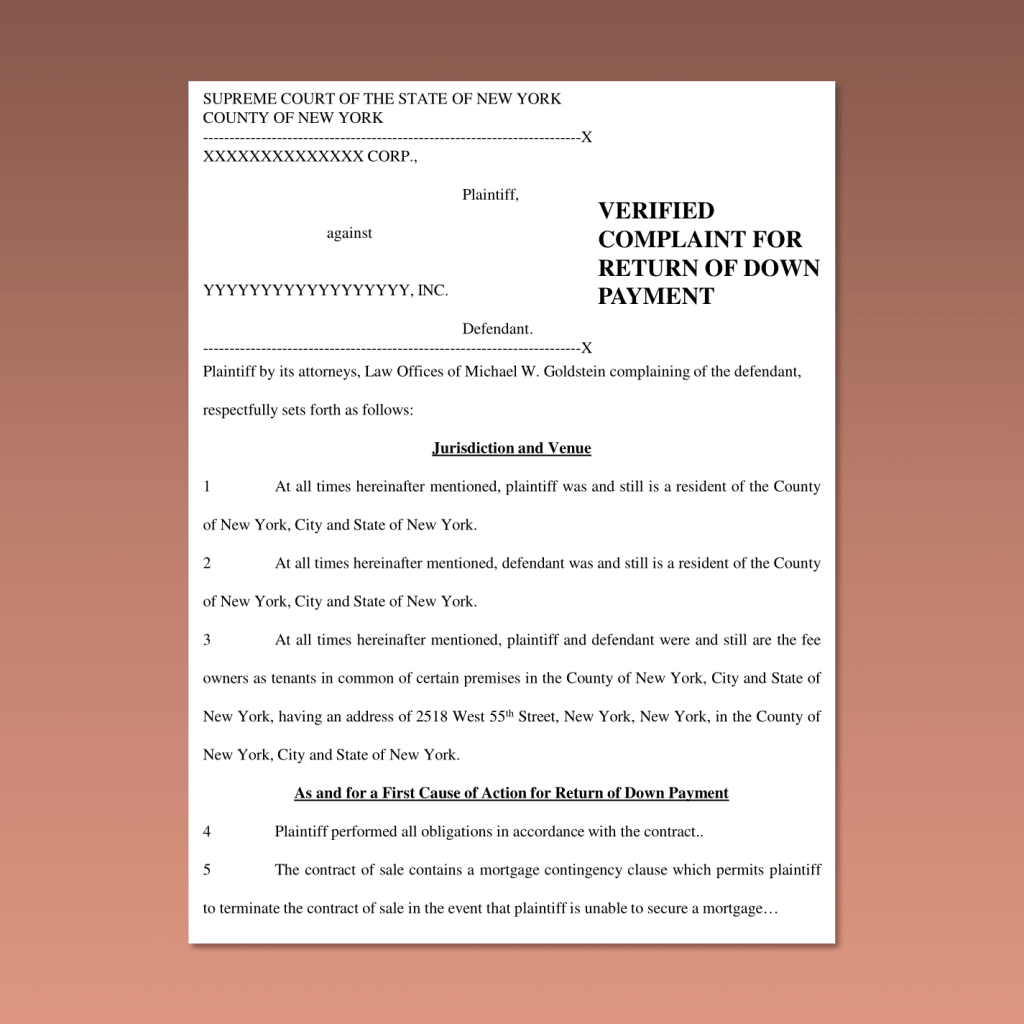

The question of whether the down payment will be returned to the buyer, or whether the seller will be entitled to keep the down payment as “liquidated damages” can usually be answered by carefully reviewing the terms of the contract of sale. A carefully drafted contract of sale should state the conditions that must be satisfied in order for the purchaser to be required to close the transaction. If the terms of the contract of sale do not clearly address the down payment disputes that caused a real estate transaction to be canceled, the parties may face a down payment dispute.

Often the Buyer Will Be Entitled to a Refund of the Down Payment

A New York real estate transaction may fail to close for various reasons. Typically, when this occurs, the parties are in agreement that the buyer is entitled to the refund of the down payment. This is because in most situations, the real estate transaction was prevented from closing due to a specific condition stated in the contract of sale. For example, a New York real estate contract should provide that the buyer is entitled to a refund of the down payment in the following situations:

- the buyer’s inability to obtain a mortgage commitment

- a title defect that the seller is unable to cure

- a certificate of occupancy that does not conform to the seller’s representations about the property

- a termite condition and resulting termite damage that the seller is unwilling to repair

- a co-op board’s refusal to approve the purchaser

In addition, a contract of sale may also contain other provisions which would entitle the purchaser to the return of the down payment if other conditions are not satisfied.

Seller May Be Entitled to Keep the Down Payment if Purchaser Breaches the Contract

Sometimes, the real estate transaction may not close as a result of the purchaser’s misconduct or breach of contract. For example, if the buyer does not obtain a mortgage commitment as stated in the mortgage contingency clause of the contract of sale, the seller is entitled to inquire as to why the mortgage commitment was not granted by the lender. If the mortgage commitment was not granted because the buyer did not cooperate with the lender in providing required financial information and documents, in all likelihood, the buyer will be in default of the contract of sale, and will not be entitled to the return of the down payment.

Unanticipated Condition That Causes the Buyer to No Longer Want the Property May Lead to a Down Payment Dispute

A real estate transaction may not close as a result of an unanticipated condition regarding the property that may cause the buyer to no longer want to purchase the property. The question of whether that unanticipated condition constitutes a legal basis for the purchaser to terminate the contract of sale depends upon the contract provisions. If that condition does not constitute a legal basis for the buyer to terminate the contract, then the seller will most likely be entitled to keep the down payment as liquidated damages. If it is not clear from the contract whether the circumstances permit the purchaser to cancel the contract, there will likely be a down payment dispute and possibly down payment litigation.

Lender Appraises the Property for Less than the Purchase Price, Causing a Down Payment Dispute

If the buyer refuses to close the real estate transaction because the lender’s appraisal of the property shows a value less than the purchase price, the terms of the contract will determine whether or not that is a valid basis for the buyer to terminate the transaction. If the contract does not give the buyer the right to terminate the contract due to an unexpectedly low appraisal, then the buyer’s refusal to close may be a breach of the contract, which might entitle the seller to keep the down payment as liquidated damages. This situation may lead to a down payment dispute and possibly down payment litigation.

Boundary Lines of the Property Reveal Encroachments, Causing a Down Payment Dispute

If a survey of the property discloses that a portion of what appeared to be the seller’s property is actually beyond the property line, and is therefore encroaching upon the neighbor’s property, or encroaching upon the property owned by the city or municipality, the contract terms will usually determine whether or not this constitutes a basis for the buyer to terminate the contract. If the contract does not adequately protect the buyer from this risk, then the buyer may be forced to either close the real estate transaction or forfeit the down payment. If the purchaser is faced with this difficult decision, there may be a down payment dispute which may lead to down payment litigation.

Certificate of Occupancy Does Not Match Seller’s Representation, Causing a Down Payment Disputes

Sometimes the buyer might refuse to complete the real estate transaction because the seller is unable to provide a certificate of occupancy, certificate of completion or other required municipal certificate or municipal letter confirming that the property may legally be used in the manner in which it was listed for sale. For example, the property might be advertised as a two-family house with a commercial space on the first floor, but the certificate of occupancy might describe the property as a 3 family house. More typically, the property might be advertised as a 3 family house of the certificate of occupancy might describe the property as a two-family house. In these examples, the terms of the contract of sale will usually determine whether or not the buyer has the right to terminate the contract and receive a refund of the down payment. If the terms of the contract of sale do not clearly state whether the buyer may cancel the contract under the circumstances, the parties may become involved in a down payment dispute or down payment litigation.

Co-op Board Refuses to Approve the Purchaser, But Buyer’s Questionable Conduct Results in a Down Payment Disputes

Another situation is unique to co-op apartments, because in almost all situations the sale of a co-op apartment is subject to the co-op board of directors’ approval of the sale to the buyer. In most situations where the co-op board of directors does not approve the sale to the buyer, the contract will automatically be terminated and the buyer will generally be entitled to the return of the down payment. However, if the buyer did not fully cooperate with the co-op board of directors in providing the information and documentation requested by the co-op board, then the refusal of the co-op board will most likely not entitle the buyer to a refund of the down payment. Similarly, if the buyer intentionally sabotaged the buyer’s interview with the co-op board, thereby resulting in the refusal of the co-op board to approve the buyer, the buyer will be in default of the contract, and will most likely not be entitled to the return of the down payment. If the facts that gave rise to the co-op board’s refusal to approve the sale to the purchaser suggest that the purchaser may not have acted in good faith, the parties may be faced with a down payment dispute followed by down payment litigation.

Who Is Entitled to the Down Payment May Be Subject to Interpretation

The circumstances causing a New York real estate transaction to be canceled often provide a relatively easy determination of whether the buyer is entitled to the return of the down payment. Many other instances where a New York real estate transaction does not close may be much less clear, and subject to interpretation, and legal arguments. A skilled New York real estate litigation attorney with substantial experience in down payment litigation may be necessary to properly protect the buyer’s or seller’s legal rights with respect to the down payment. An experienced New York real estate litigation lawyer may be able to resolve the issue before the down payment dispute becomes down payment litigation.

Seller’s Legal Rights When a Real Estate Transaction Is Canceled by the Buyer

If a real estate transaction fails to close, the seller (who has kept the property off the real estate market for several months during the pending real estate transaction) has likely incurred unreimbursed expenses such as real estate taxes and mortgage interest. This would be especially troublesome if the property had been vacated in anticipation of the closing of the real estate transaction. Whether the seller has the legal right to be compensated for the carrying costs or other expenses of the property is based solely upon the terms of the contract of sale. More significantly, whether the seller has the legal right to retain the down payment after the purchaser cancels the contract of sale, is based upon whether the purchaser’s cancellation was permitted by the terms of the contract of sale. An experienced New York down payment litigation lawyer’s careful review of the contract of sale, as well as the circumstances that caused the cancellation of the contract, may facilitate a resolution of the down payment dispute before it evolves into down payment litigation.

The Role of an Experienced New York Real Estate Litigation Lawyer for Your Down Payment Disputes

Certainly, the transactional lawyer has participated in the negotiation and drafting of the contract, and has been deeply involved in the facts and circumstances that gave rise to the termination of the contract. Nevertheless, in our experience, that may result in the inability to focus on the entirety of the transaction, and the inability to objectively determine each party’s legal rights with regard to the down payment. Furthermore it might interfere with the development of a winning strategy to negotiate a resolution of the down payment dispute, or to litigate the down payment issues

In my experience as a New York real estate litigation lawyer representing buyers or sellers in down payment disputes, I have found that my involvement as litigation counsel often brings an entirely new perspective to the down payment dispute. My careful review of the contract of sale, and in-depth analysis of all the circumstances surrounding the transaction, including but not limited to the events that caused the termination of the transaction, are instrumental in developing innovative successful strategies for negotiation and/or litigation regarding the down payment.

If you find yourself involved in a down payment dispute, it is important that you retain a New York real estate litigation lawyer experienced in down payment disputes and down payment litigation. Our New York real estate litigation lawyer represents buyers and sellers in New York real estate down payment disputes. Importantly, our New York real estate litigation lawyer is also well versed in negotiating, drafting and interpreting New York real estate contracts of sale.

When we are presented with a New York real estate down payment dispute, we carefully review the entire contract of sale, and all the facts and circumstances of the transaction. In our representation of buyers, we have often successfully obtained a refund of the down payment, based upon our evaluation of the circumstances that caused the transaction to fail and our interpretation of the contract provisions. In other situations, we have been able to obtain a refund of the down payment based upon our discovery of other facts and circumstances that constituted a breach of the contract by the seller, even though that breach was not the actual event that caused the transaction to be canceled. Our many decades of experience negotiating, drafting and interpreting New York real estate contracts, as well as our many decades of litigation experience give us the unique ability to provide the highest level of representation for buyers or sellers in New York down payment disputes and New York down payment litigation.

New York Real Estate Litigation Lawyer Working with Your Real Estate Transactional Lawyer to Resolve Your Down Payment Disputes

We can provide legal representation in conjunction with your New York real estate transaction lawyer, in order to facilitate a resolution prior to litigation. Alternatively, if the down payment dispute cannot be resolved amicably, we can provide top-tier legal representation for your New York real estate down payment litigation.

Although we cannot make any guarantees, our track record in representing clients in down payment disputes has been very impressive. We have even been complemented by several of our adversaries after the down payment disputes have been resolved, either prior to litigation or in the course of litigation.

Contact Our New York Real Estate Down Payment Litigation Attorney To Discuss Your Down Payment Dispute

Are you involved in a New York Real Estate down payment disputes? If so, we invite you to complete our Real Estate Down Payment Litigation Questionnaire or click Contact Us. You may also call Michael W. Goldstein for a free initial telephone consultation, or to schedule a consultation at our office.

Disclaimer | NY Real Estate Down Payment Disputes Litigation

Visiting our website, submitting any information via questionnaire or email, or discussing your New York Real Estate breach of contract or down payment dispute with our NY Real Estate Down Payment Litigation Attorney does not create an attorney-client relationship. An attorney-client relationship with our law firm or with our NY Real Estate Down Payment Litigation Attorney can only be established with the signing of a written retainer agreement prepared by our law firm.

Prior results do not guarantee or predict a similar outcome with respect to any future case or legal matter.

Law Offices of Michael W. Goldstein

New York Real Estate Down Payment Disputes Lawyer

New York Real Estate Down Payment Litigation Lawyer

Free Phone Consultation

Attorney Advertising