NY Wills, Trusts & Estates

The Law Offices of Michael W. Goldstein is a New York Probate, Wills Trusts & Estates Lawyer representing clients in various aspects of estate practice, including:

- Wills

- Trusts

- Living Wills and Health Care Proxies

- Powers of Attorney

- Estate Administration

- Estate Probate

- Will Contests

- Surrogate’s Court Litigation

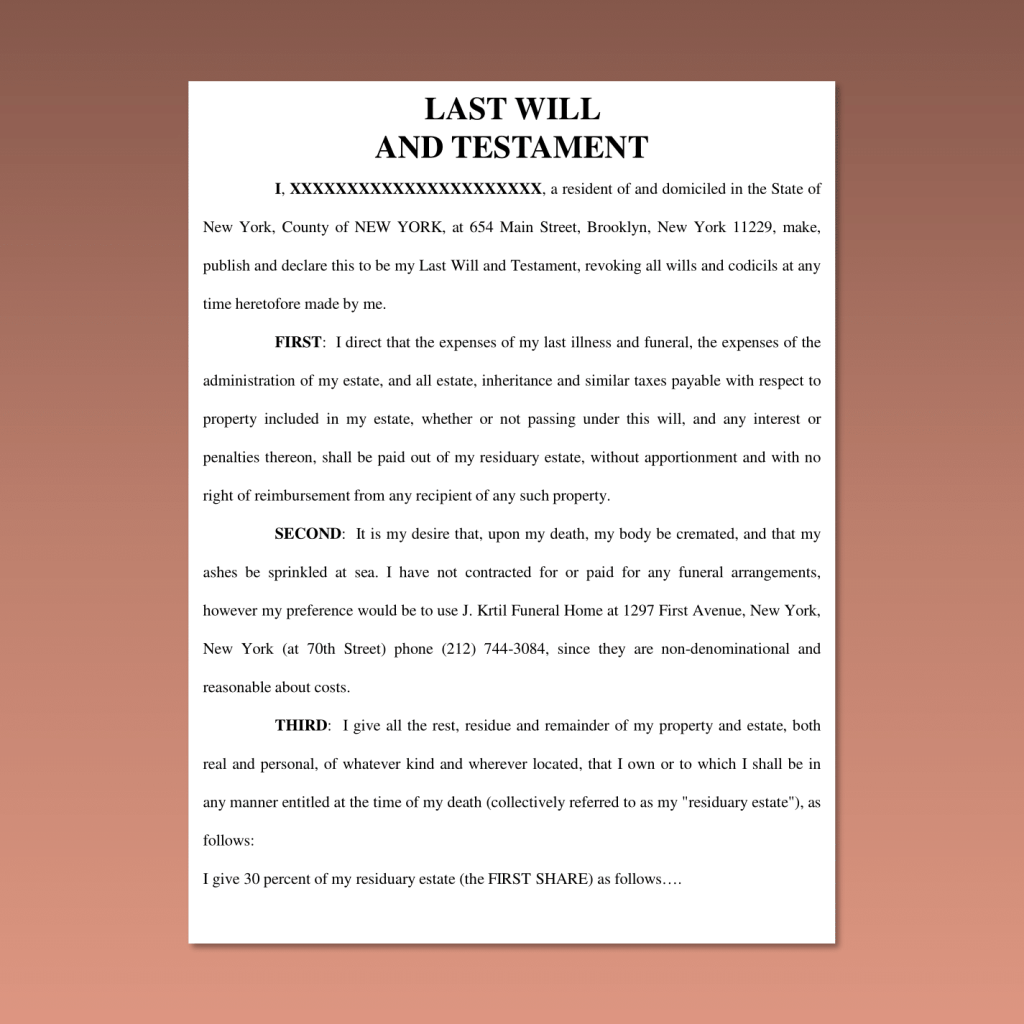

Wills

If you are a New York State resident, and die without leaving a valid legally enforceable Will (“Last Will & Testament”), your assets (other than those held jointly, or as tenants-in-common or tenants by the entirety, or containing a designated beneficiary) will be distributed according to the laws of intestacy. Accordingly, if you die without leaving a valid Will, all or a substantial portion of your assets may be inherited by relatives who were not your intended beneficiaries. Therefore, we recommend that you execute a Will, with the assistance and guidance of an experienced New York Probate Lawyer. We also suggest that your Will be reviewed periodically, to be sure that it accurately states your current intentions.

In New York, your Will directs how your property will be distributed when you die. This may include bequests of specific items of personal property (cars, jewelry, art work, and other personal property), real estate (house, condominium, land, etc.), co-op apartment (which is classified as personal property), financial assets (bank accounts, stocks, bonds, investments, etc.)

The Will affects assets that are owned solely in the decedent’s name and do not have a designated beneficiary. The Will should also identify the executor, who will follow your instructions regarding managing and distributing your assets after you die. In addition, a Will may also designate a guardian to take care of your minor children. If you are legally responsible for the care of an adult, or a child who has a mental disability, your Will may appoint a guardian or conservator to continue caring for them.

If you are a New York State resident, your Will must be prepared and properly executed in accordance with the strict requirements of New York law, in order to ensure that the Surrogate’s Court will recognize the validity of your Will. Keep in mind that if all the legal requirements and formalities required by New York law are not strictly followed, the testator’s attempt to create a valid Will, or to modify an existing Will (by a Codicil), or to replace an existing Will with a newer Will, may be ineffective. In New York State, if a Will is not executed in conformity with all the New York statutory legal requirements and procedural formalities, a disgruntled relative might have a basis to contest the Will. Even if the Will contest is successfully defeated by the estate’s executor, significant unnecessary legal expenses and delay in distributing the estate’s assets may be incurred.

If the Will or Codicil is found to have not been executed in conformity with New York’s statutory requirements and procedural formalities, the Will or Codicil might be declared invalid by the Surrogate’s Court. If the most recent Will is declared invalid, the decedent’s assets would be distributed in accordance with the terms of a prior valid Will, or if there is no prior valid Will, then the assets would be distributed as if the decedent had died without a Will. Either alternative may result in the decedent’s assets being distributed vastly differently than the decedent intended. As an experienced New York Probate Lawyer, we can draft your Will or Codicil, and make sure it is executed following New York’s strict statutory and procedural requirements. We believe that is the best way to insure that the distribution of the decedent’s assets will follow the testator’s expressed intentions.

Trust

The document that creates a Trust is usually called a Declaration of Trust. The person who creates the trust is referred as the “grantor” or “settlor” or “creator”. The “trustee” is the person named in the trust to manage and distribute the trust assets in accordance with the terms of the trust document. In every trust, the trustee has a “fiduciary duty” to follow the directions of the trust document, and manage and distribute the assets of the trust for the benefit of the beneficiaries.

Testamentary Trust

A Testamentary Trust is a trust that becomes effective only upon the death of the person creating the trust. The Testamentary Trust is not created by a separate trust document, but rather is created as part of the grantor’s Last Will and Testament (“Will”). Since a Will may be changed or replaced during the testator’s lifetime, the Testamentary Trust created in the Will may also be changed, replaced or eliminated entirely. In New York State, specific statutory procedures and formalities must be followed in order to create a valid Will, modify an existing Will (by a Codicil), or replace an existing Will with a new Will.

A Testamentary Trust may provide for payment of income or distributions of trust assets to named beneficiaries (such as minor children or disabled children), either in amounts stated in the trust document or as determined in the trustee’s discretion. If a Will was not properly executed and is held invalid by the Surrogate’s Court, any Testamentary Trust created in the Will is likewise invalid. The importance of having a New York Will drafted, and the signing of the Will supervised by a New York Wills, Trusts & Estates attorney who is familiar with these requirements is crucial to creating a valid and enforceable Will, Codicil and/or Testamentary Trust.

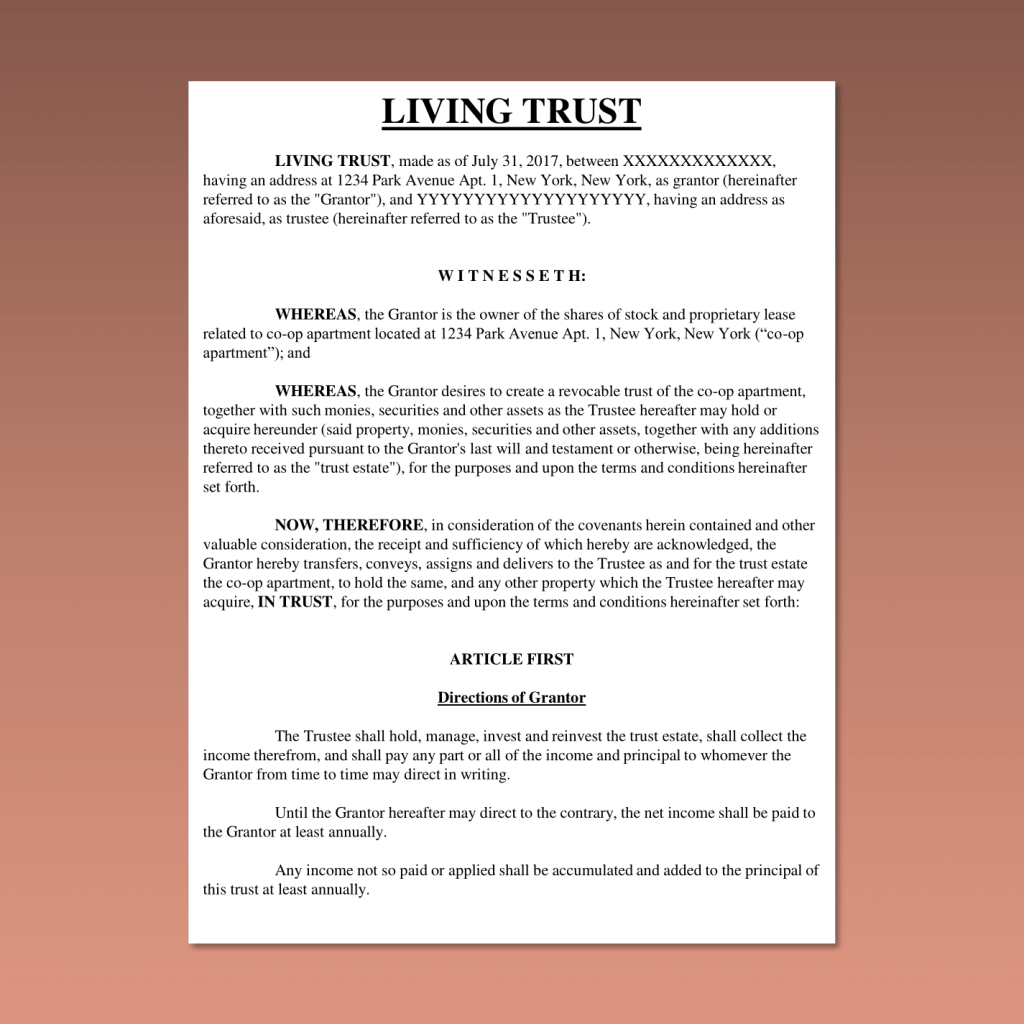

Living Trust

A Revocable Living Trust (also called an Inter Vivos trust) is created during the lifetime of the “grantor” (person who transfers property to the trust.) The Revocable Living Trust is sometimes referred to as a Family Trust. The trust property is held by the trustee, who is legally required to use the property for the benefit of the beneficiaries.

The grantor of the trust is sometimes referred to as the “settlor”. In a Revocable Living Trust, the grantor is often the trustee during his or her lifetime, and may also be a beneficiary. The Revocable Living Trust may be changed at any time by the grantor, who may even cancel the trust and retake ownership of the trust assets. The living trust contains directions regarding the management and distribution of the trust assets, both during the lifetime of the grantor, and after the grantor’s death.

Trust assets may be distributed to the named beneficiaries after the grantor’s death without a probate or administration proceeding. A revocable living trust may enable all or a substantial portion of your assets to be distributed upon your death, without the substantial delays and fees incurred in probating a Will in the New York Surrogate’s Court.

If all of your assets are held by a living trust, a Surrogate’s Court proceeding would probably be unnecessary. Nevertheless, since many people who have a living trust also retain ownership of some assets in their own name, it is recommended that a Will also be executed, to provide for the distribution of any non-trust assets. If there is no Will, any non-trust assets may be distributed in accordance with the laws of intestacy. This often results in unintended beneficiaries inheriting a portion of the decedent’s estate that is not owned by the trust. To prevent this undesirable result, it is generally recommended that both a revocable living trust and a Will be executed.

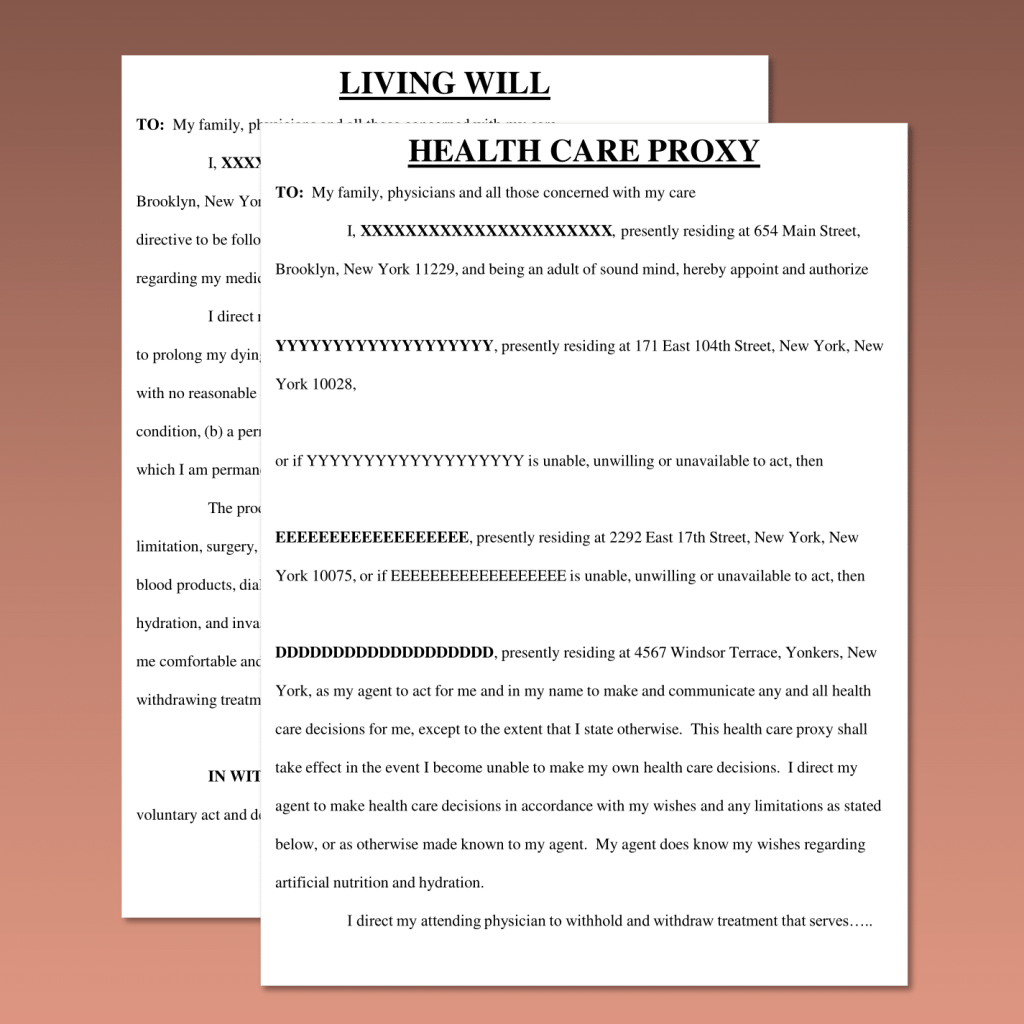

Living Will & Health Care Proxy

The Living Will expresses your wishes regarding your medical treatment, in the event that you become mentally or physically incapacitated. The health care proxy designates a trusted relative, friend, etc. to make health care decisions for you. In order to be valid in New York, these documents must be executed in conformity with the requirements of New York law.

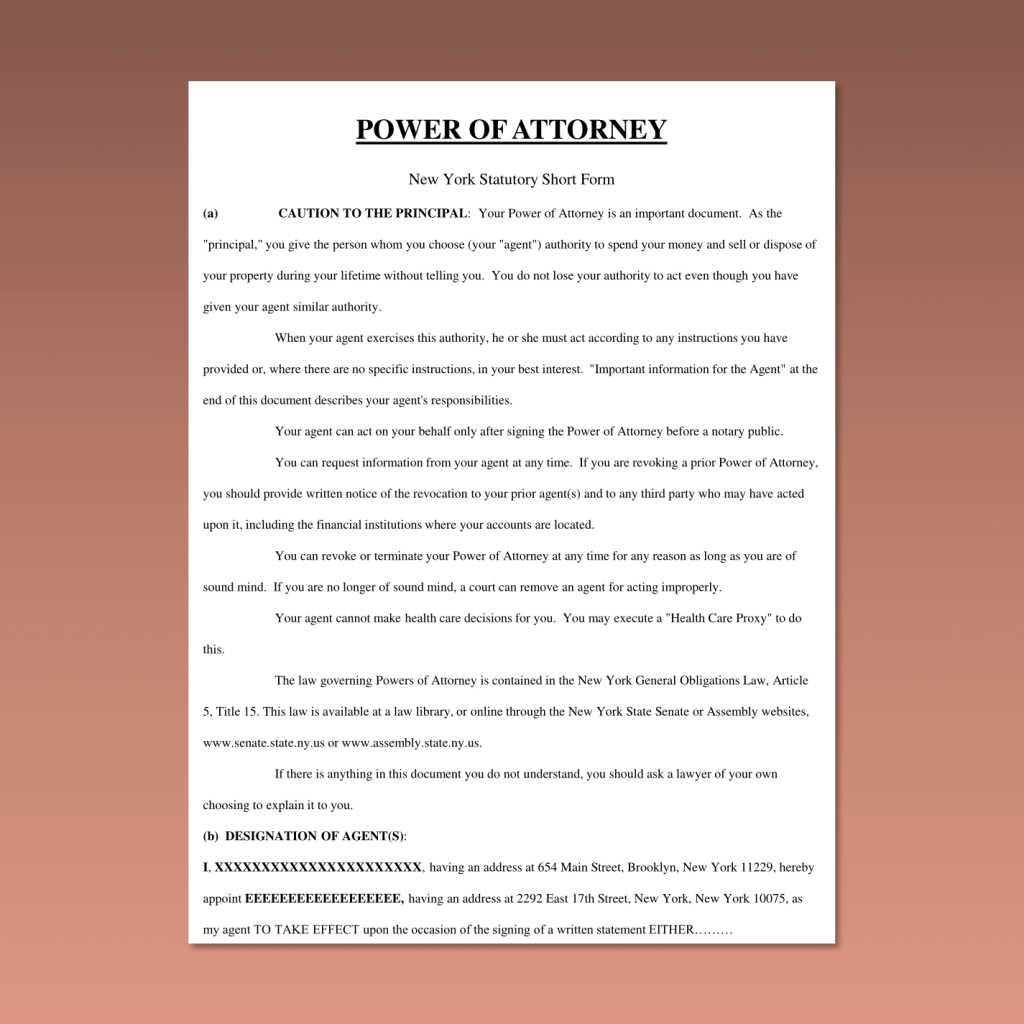

Power Of Attorney

A Power of Attorney can be broad and unlimited in scope, or it may be limited in various ways. It should be carefully prepared to best serve the desired purpose and intention of the person granting the Power of Attorney. It may authorize a trusted relative, friend or other designated person to take care of your financial matters, in all circumstances, or in limited circumstances. It can be limited to a particular transaction, or type of transaction, or it may be broad in scope.

The Power of Attorney may be effective immediately, or may only become effective in the event that you become mentally or physically incapacitated, or upon some other occurrence. A Durable Power of Attorney remains in effect even if the person who signs the Power of Attorney becomes mentally or physically incapacitated.

A Power of Attorney can be useful if you are unable to be present at a real estate closing or business transaction. It may also be helpful in the event that you become mentally or physically incapacitated, and therefore are unable to take care of your financial matters yourself.

The person granting the power to act under the power of attorney is called the “principal” (previously the “donor”) and must be at least 18 years old. The person you select to act in your place is called your “attorney-in-fact” or “agent”. This does not mean that the person is actually an attorney. A Power of Attorney may provide alternate appointments, in the event that any of the people selected by you are unable or unwilling to assume the designated responsibilities.

The principal of the Power of Attorney may revoke the authority granted during his or her lifetime, however such revocation will not nullify actions already taken by the attorney-in-fact prior to the revocation.

A Power of Attorney is not a substitute for a Will. In fact, the Power of Attorney is only effective during the lifetime of the person creating it, and it automatically terminates upon the death of the person granting the power. In contrast, the Will only becomes effective upon the death of the testator (person signing the Will.)

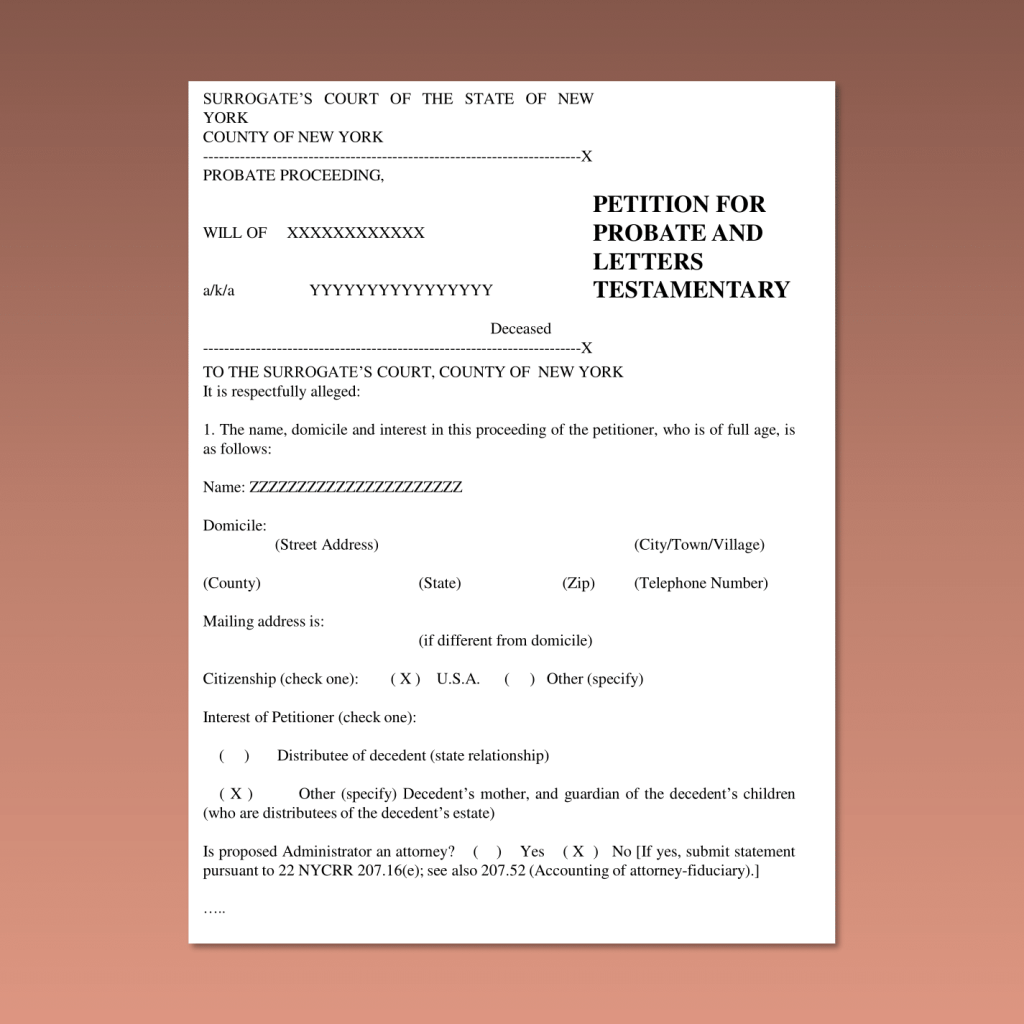

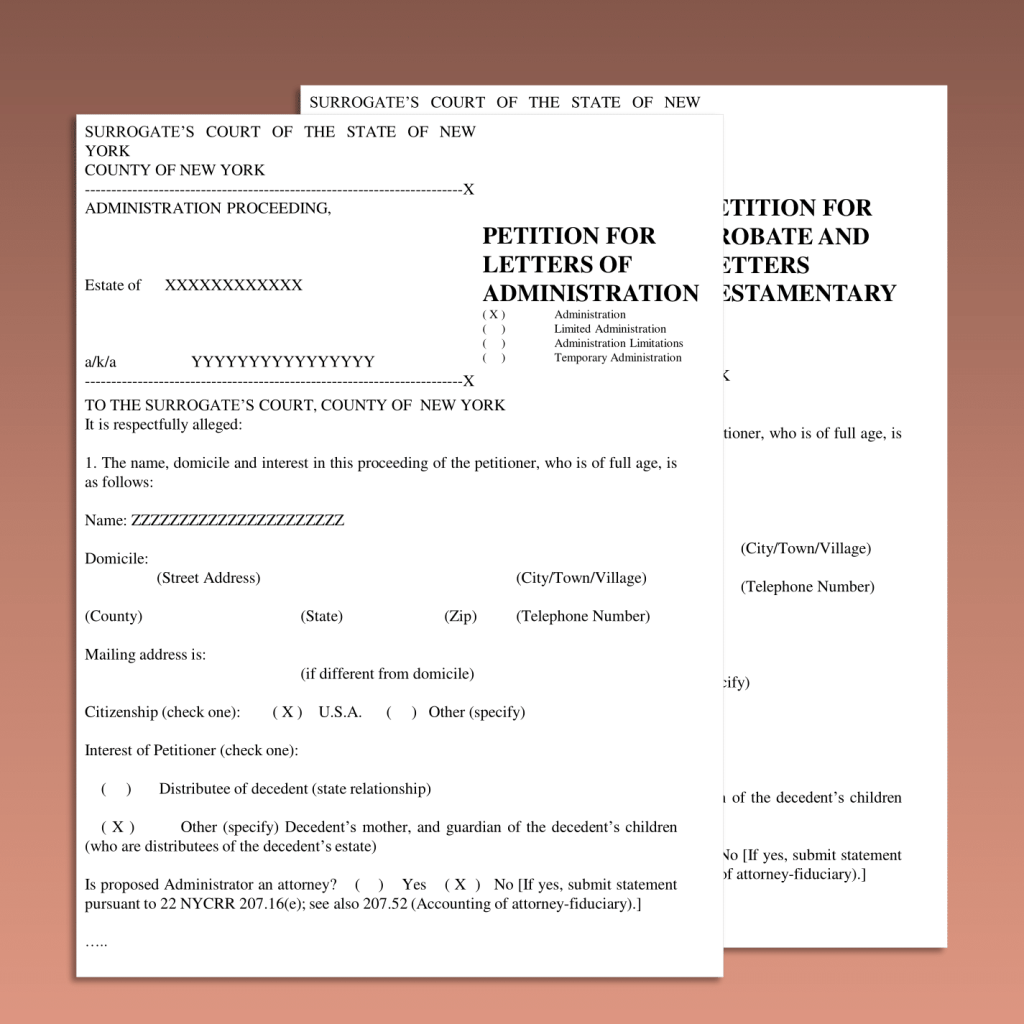

Estate Probate or Estate Administration

When a loved one unfortunately dies, in addition to dealing with the shock and grief, the matter of administering or probating the estate needs to be addressed. Our experienced and compassionate New York Probate Lawyer is here to assist you in that procedure. If the person who died (“decedent”) had a valid Will, the process is referred to as probating the estate. If the decedent had no Will, the process is called administering the estate.

If the person who died was a resident of New York State, and had assets in both New York and in another state, it might be necessary to probate or administer the estate in New York, and also to have an ancillary probate or ancillary administration proceeding in the other state. The reverse situation may arise if the person who died was a resident of another state, with assets in that state as well as in New York. In that situation, the estate may need to be probated or administered in the state of the decedent’s domicile (primary residence), and an ancillary probate or ancillary administration might be required in New York State.

Our experienced New York Probate Lawyer and New York Administration Lawyer can represent the estate of a decedent who was a resident of another state or country, but died having assets located in New York. We can prepare and file the documents needed for a New York Ancillary Probate or New York Ancillary Administration.

Contact Our New York Wills Trusts & Estates Lawyer

To discuss a New York Will, Trust, Living Will, Health Care Proxy, Power of Attorney, Estate Probate, Estate Administration, or other estate matter with our New York Wills, Trusts & Estates Attorney, we invite you to complete our Wills, Trusts & Estates Questionnaire, or click Contact Us. You may also call Michael W. Goldstein for a free initial telephone consultation, or to schedule a consultation at our office.

General Disclaimer

Visiting our website, submitting any information via questionnaire or email, or discussing your case with us does not create an attorney-client relationship with our law firm. An attorney-client relationship with our New York Wills, Trusts & Estates Lawyer can only be established with the signing of a written retainer agreement prepared by our law firm.

Prior results do not guarantee or predict a similar outcome with respect to any future case or legal matter.

This website is not intended to solicit clients for drafting a Will, Trust, Living Will, Health Care Proxy, or Power of Attorney outside of New York State, or for the probate or administration of an estate outside of New York State, or for any other legal matter outside of New York State. However, we do represent clients who have completed a Surrogate’s Court proceeding in another state for a decedent who was domiciled in that state, but had assets in New York State, which require an Ancillary Probate or Ancillary Administration in New York State. We also represent clients who live outside of New York State, and need legal services for an Estate Probate or Estate Administration in New York State.

New York Wills, Trusts & Estates Lawyer Disclaimer

The New York Wills, Trusts & Estates information, or other legal information contained in this website is not intended to constitute legal advice, nor to create an attorney-client relationship or lawyer-client relationship with our New York Probate Lawyer or New York Wills, Trusts & Estates Lawyer. We recommend that you discuss your Will, Trust or Estate matter, Living Will, Health Care Proxy, Power of Attorney, Estate Probate, Estate Administration, or other Surrogate’s Court proceeding with a New York Wills, Trusts & Estates Attorney promptly.

Michael W. Goldstein is a New York Probate Attorney and NY Surrogate’s Court Lawyer representing clients in drafting Wills, Trusts, Living Wills, Health Care Proxies, and Powers of Attorney, and in Estate Probate, Estate Administration, and other New York estate matters.

Our New York Wills, Trusts and Estates Lawyer represents clients in New York State, including New York City, Manhattan, Bronx, Brooklyn, Queens, Staten Island, Long Island, Nassau County, Suffolk County, Westchester County, Rockland County and upstate New York.

Law Offices of Michael W. Goldstein

New York Probate Lawyer

New York Wills, Trusts and Estates Lawyer

Free Phone Consultation

Attorney Advertising